What is Flare?

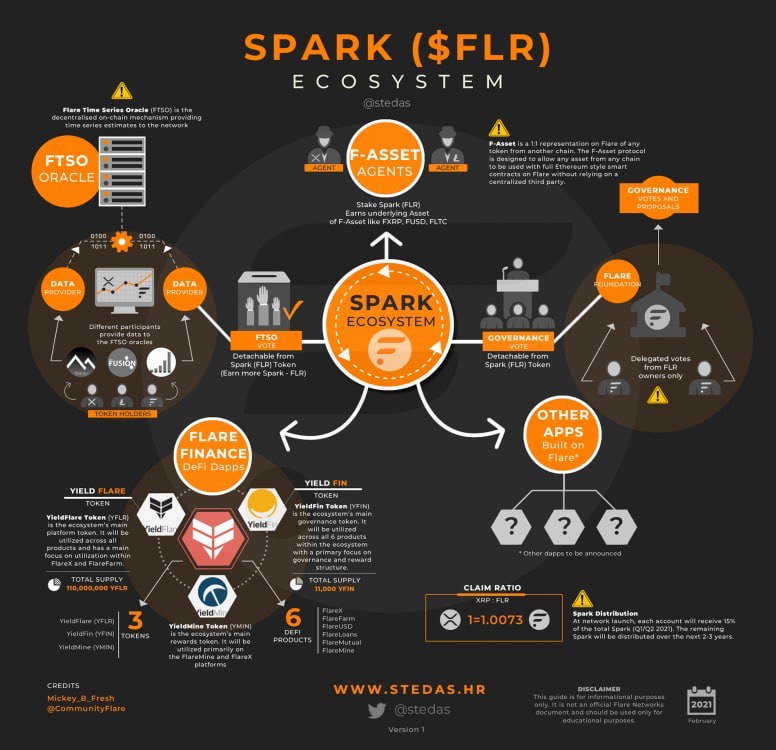

Flare is a new layer 1 blockchain that brings non-smart contract assets onto the network and issues a 1:1 representation called F-Assets which have smart contract capabilities. It achieves this by participants called agents, locking up the native token $FLR as collateral in order to issue F-Assets. Additionally, Flare network allows other layer 1 blockchains to be connected through its secure bridging protocol, called LayerCake.

Both F-Asset and LayerCake protocol relies on Flare’s State Connector system which is a smart contracts protocol that can retrieve off-chain information and data sets. The State Connector can determine if an event has occurred in an external network, that this information is objectively verifiable.

A built-in decentralised oracle called the Flare Time Series Oracle (FTSO) will also exist as part of Flare’s core protocol stack, which allows independent data providers to feed in prices of crypto assets. FTSO data provides price information on, but not limited to, F-Assets, $FLR, $SGB and LayerCake bridging assets.

What is the consensus mechanism for Flare Network?

The underlying consensus protocol leveraged by the Flare Network is the Avalanche Consensus Protocol. Avalanche is a flexible protocol that can be deployed with a different network topology. The network consensus for Flare is organised in an FBA structure with a specific modification to include a Unique Node List (UNL) topology. UNL topology requires nodes to rely on other sets of nodes intersecting for consensus. Flare uses the Ethereum Virtual Machine (EVM) for smart contracts functionality. It’s important to note that Flare does not rely on economic safety mechanisms to secure its network .

What is Flare’s native token and what is its primary use case?

FLR is the native token of the Flare Network. FLR’s technical purpose in the system is to prevent network spamming by imposing a disincentivisation cost upon transactions via transaction fees. Transaction fees in Flare are burnt rather than accruing to some set of participants (network miners, in the case of Ethereum’s PoW). Additionally, FLR serves as the primary vote power for Flare’s decentralised network governance. FLR holders therefore determine network parameters after the Flare Network is launched.

Are there other use cases for FLR?

FLR has many key roles in operating FLR Dependent Applications (FDA), which are novel decentralised applications on Flare. SDAs may use FLR as collateral, to mediate governance or using the Spark mediated on-chain Flare Time Series Oracle.

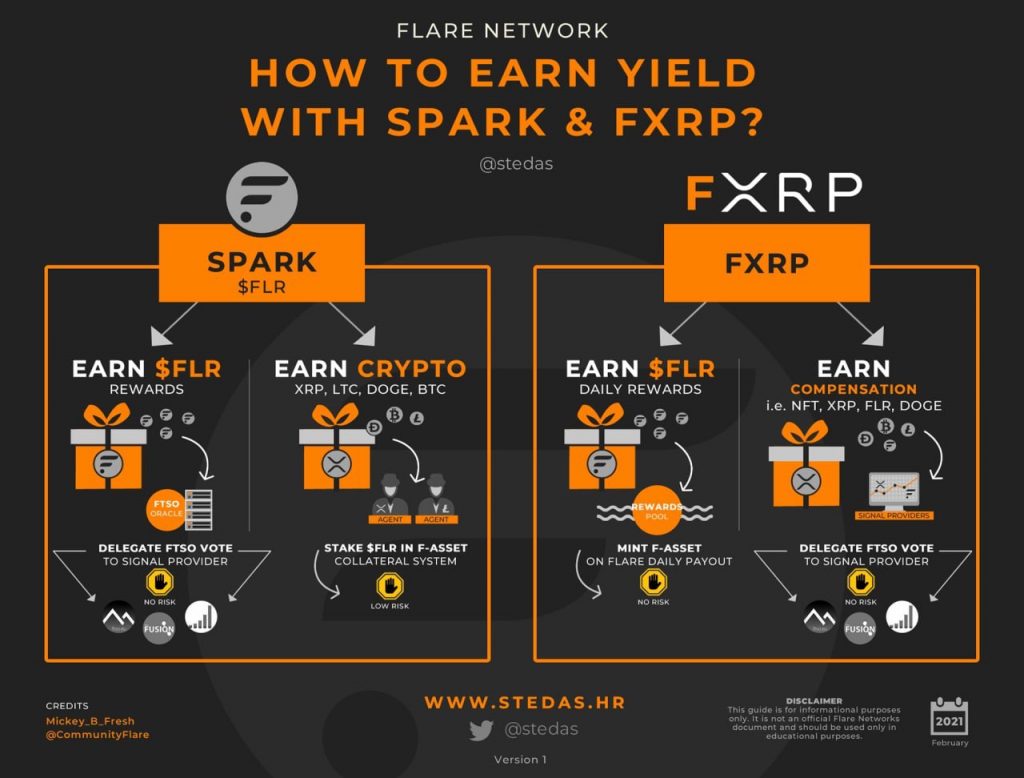

Each FLR has a separate detachable vote that FLR holders can delegate to data providers in the Flare Time Series Oracle (FTSO) system (one of the core protocols of the Flare Network). This delegation earns FLR from the programmed FTSO inflationary rewards if the data providers obtain the correct price feeds for crypto assets that may be used in the future on the Flare Network (See https://flaremetrics.io/). A built in decentralised oracle at the ground level of the Flare Network that can scale to capture Web2 time series data will be foundational to the many novel dApps interacting on Flare.

Additionally, FLR is used as collateral in the F-asset system (another core protocol of the Flare Network). Users may want to mint F-Assets from their underlying non-Turing complete blockchain assets that do not inherently have smart contract capabilities. By paying a small fee to agents who put up the collateral in the minting process, F-Asset holders receive FLR rewards from the General Rewards Pool thus transforming the underlying assets into a yield bearing asset on the Flare Network.

FLR is also used within the LayerCake protocol on Flare by Bandwidth Providers locking up their FLR as collateral. LayerCake is a fast and secure bridging protocol that moves assets between L1 smart contract blockchains. The amount of FLR collateral provided by a Bandwidth Provider must match the amount of value deposited by the Bandwidth Provider on the origin L1 chain. Thus FLR is critical in the Layercake protocol to provide insurance against faulty bandwidth providers.

What is the tokenomics and distribution plan for $FLR?

Spark (FLR) is the native token of the Flare Network. There is a soft total supply of 100B FLR at launch. FLR will be distributed at launch to XRP holders that took part in the FLR airdrop claim process. According to the white paper, 25B FLR tokens will go to Flare Networks Limited and 30B FLR tokens will go to the Flare Foundation. Approximately 30B will be going to XRP holders as part of the claiming process to distribute Spark tokens. The remaining FLR will go to the network’s rewards pools used to incentivise Spark dependent applications.

The FLR token has many use cases critical to the operation of the Flare Network. It. can be used for many purposes due to the network not requiring FLR to be used in the network’s consensus. FLR is decentralised at launch and its future distribution is relatively known.

Supply of FLR:

- Total Onset Supply = 100B FLR. This is not a hard cap on the supply. FTSO inflationary supply will increase the total supply over 100B.

- Circulating Supply at t = 0 (launch) ~ approx. 5B FLR (15% of claimed FLR) + a portion of the 20B FLR (Flare team and investors)

- Circulating Supply at t = 1 year ~ approx. 5B FLR (initial launch) + 12B FLR (12 months of claim) + n FLR (FTSO) + n FLR (F-assets rewards / BP) + a portion of the 20B FLR (Flare team and investors)

Inflationary Effects (Supply Released into Circulation):

- FTSO – Set at 5% of the Circulating Supply, to be newly minted and released in a staggered distribution, i.e highest initially.

- State Connector system rewards to Attestation Providers likely derived from the newly minted inflation (same as FTSO)

- F-Asset general rewards pool (20-25B FLR), also highest to those who mint F-assets early. Although $FLR is released into circulation, users obtaining such rewards are likely to deploy

FLR into Flare protocols instead of selling on exchanges.

- LayerCake protocol rewards from the same pool as F-Asset general rewards?

- FLR distribution from XRP holders (30B FLR: 15% at launch, 2.37% per month thereafter)

Deflationary Effects (Demand for FLR):

- FLR used as collateral for minting F-assets (either by self-minting or agent) ~ 2.5X value of mint

- FLR locked temporarily by Bandwidth providers in Layercake protocol

- FLR to mint NFTs on Flare?? (Speculation)

- FLR to be provided as liquidity in DeFi?? (Speculation)

What is the mechanism of creating and redeeming a 1:1 representation of an asset on Flare?

We will use the example of XRP to create FXRP in a trustless and decentralised manner on Flare. To do this, an XRP holder (the originator) sends their his/her XRP to a series of accounts maintained on the XRPL by parties called agents. The agents lock up Flare’s native token Spark (FLR) as collateral against which FXRP can be issued and redeemed. The collateralisation ratio for agents is said to be approximately 250%, or 2.5X the value of the underlying asset. In this process, the originator will pay a fee (up to 5%) in XRP which goes to the agent for facilitating this process. The newly issued FXRP will be received by the originator in their specified account on Flare.

The redemption process for FXRP is the reverse of the issuance process. In the redemption process however, the redemption fee is much lower than the 5% fee issuance fee that goes to the agents. In the event that an agent does not return an equivalent amount of XRP to the redeemer, the agent’s collateral in FLR will be used to reimburse the redeemer plus a margin to compensate for the transaction fees to replace the XRP. Agents who do not honor the redemption process are heavily penalised by losing 50% of their remaining FLR collateral remaining. The penalised amount is burnt by the F-Asset system.

Variables such as creation and redemption fee, collateralisation ratio and other parameters can be changed through governance proposals. See the Governance section of this document.

What are the costs and risks of minting F-Assets?

To mint any F-Asset, a user must pay a minting fee (up to 5%) in the underlying asset being minted. This fee goes to agents which are entities providing $FLR collateral to the F-Asset system. Agents overcollateralise the system at 250% (2.5X value of the mint) to account for any price volatility in $FLR.

The underlying asset remains on the native blockchain, secured and locked by smart contracts. As explained above in the case an agent does not honour the redemption process of F-Assets, the agent’s collateral in FLR will be used to reimburse the redeemer plus a margin to compensate for the transaction fees to replace the F-Asset.

Why mint F-Assets?

F-Assets are transformed assets that have superpowers. Whereas the underlying asset does not have smart contract capabilities, F-Assets can be used in DeFi applications to earn yield or engage in the NFT ecosystem and more. Furthermore, F-Assets are yield bearing assets as they earn daily $FLR rewards from the network’s rewards pool. The rewards in $FLR can then be delegated to the FTSO system to earn $FLR rewards and simultaneously be used for providing collateral to the F-Asset system for others to mint, thus earning you fees in the native asset being minted.

How is Flare’s decentralised network governed?

Governance decisions are made through voting using the Spark token. Each Spark token equals one vote. Mechanisms over the Flare Network, the Spark token and the FTSO are governed by such votes.

Variables and parameters within the F-Asset system can be voted to change through governance decisions only. Different governance decisions have different impacts on the network so will require a specific number of Spark tokens participating (turnout) in the voting process to enact the change. Spark tokens held by the Flare Foundation may not be used in governance decisions.

What is the role of the Flare Foundation?

The Flare foundation is to be a non-profit organisation whose mandate is to participate in developing and improving the network. The foundation undertakes this in five ways:

- Grants –

- Investments –

- Direct software development –

- Education content & publicity –

- Partnerships –

To restrain the Flare foundation from obtaining excessive power in the network through any economic processes that operate on the network, the foundation is bound by a set of rules:

- No voting – of any governance processes. However, the foundation may provide opinions and technical analysis over governance proposals

- No collateral – can be provided for use in SDAs

- No oracle participation – in the FTSO system such that the award rate given to non-foundation participants will naturally reduce the importance of the foundation (in Spark token holdings and governance) relative to other network participants.

- The right to dissolve – if the network participants vote to do so. All Spark token holdings will be burnt if dissolution of the foundation occurs.

- Reporting – sales of Spark tokens, employee remuneration, expenses and other use of funds, investments and grants. Reporting will be done every 6 months.

What is Flare’s Roadmap for Launch and after?

The White Flare paper https://drive.google.com/file/d/193JQKBZ-tZ1zuM8BkaTe_RWYhhZCjwIN/view