Part 2: What is the Flare Time Series Oracle (FTSO)?

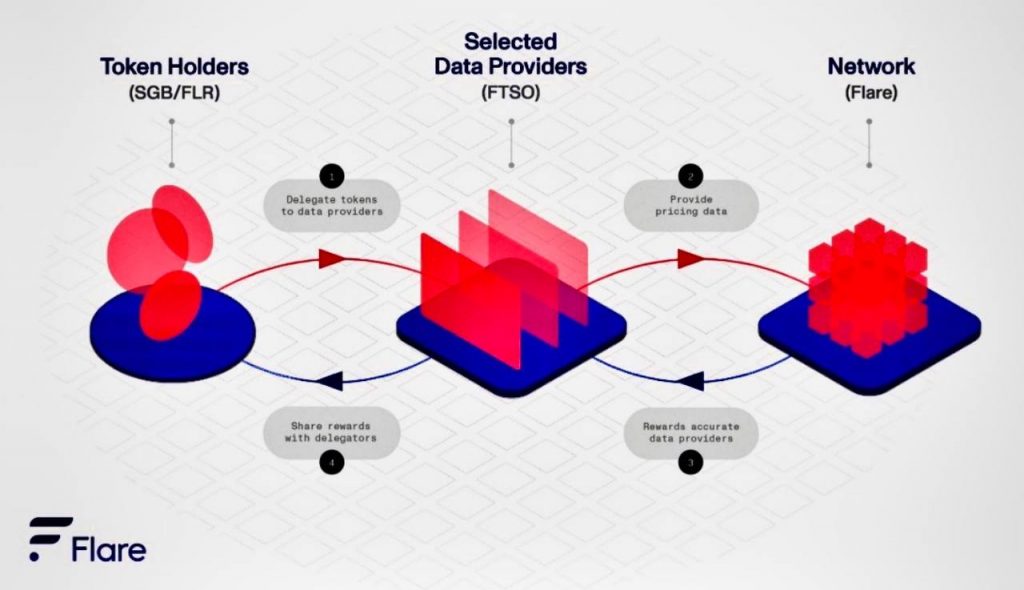

The Flare Time Series Oracle (FTSO) records the price of assets from another chain and brings this data on-chain in a decentralised and periodic manner. The time series is not limited to the price/value of off-chain assets and may include other data sets. The time series estimates generated by data providers are deemed to be correct if their estimates remain within the weighted mean of the final truncated distribution set. This removes outlier data estimates which may contain errors or attempts to be malicious. Ultimately, data providers are incentivised to capture accurate time series data on-chain to improve the accuracy of the oracle system.

The FTSO has a reward function which generates new Spark (FLR) tokens to those that provide price estimates within the accepted range. FLR holders who do not directly provide price estimates are able to delegate their votes to price data providers in a liquid democracy model and also be compensated with the FTSO inflationary rewards. Vote power is capped so no single price provider can have too much vote power. The FTSO system will be able to handle thousands of price providers and thousands of price series.

Why the need for the FTSO?

The Flare Network is built to be a decentralized blockchain; however, for the smart contracts on the network to function properly, it has to rely on external price data that may be centralized. If the Flare Network were to utilize an exchange’s price data, then this would render the system centralized itself. Thus, the Flare team built the Flare Time Series Oracle (FTSO) as a mechanism to decentralize the price data estimates coming onto the chain.

Who contributes to the FTSO?

F-Assets (i.e. FXRP, FLTC, FDOGE, FXLM, FALGO) and FLR holders alike will be the contributors of price data estimates to the FTSO. FLR holders who delegate their detachable vote to the FTSO are contributing to the decentralization of external price feeds into the Flare Network and will be rewarded in FLR for providing accurate price data estimates. F-Asset holders will not be rewarded by the FTSO for their contribution, but will be assisting in the integrity of the underlying smart contracts used to create and maintain their F-Asset position. To accomplish this, both asset types can delegate their votes through a signal provider.

How to earn FLR rewards from the FTSO?

As a FLR holder delegating their detachable vote to the FTSO, each holder will be able to earn rewards in FLR, when they provide accurate price data estimates. For a price data estimate to be considered accurate, the feed must be in the median 50% of all price data estimates for each given FTSO time series closure, which happens on a per minute basis. While F-Asset holders who contribute to the FTSO do not earn the FTSO rewards, it is possible a dynamic marketplace will be created by signal providers to accrue more voting power resulting in payment to F-Asset holders delegating their votes to a signal provider.

FTSO as an inflation mechanism

The Flare Network tokenomics for FLR utilize an inflationary mechanism through which additional FLR are delivered to participants of the FTSO. This means that rather than FLR serving as a deflationary asset it will be able to have the supply increased to scale to the growing value on the network. However, unlike inflation in traditional markets where the rate is controlled by a central bank, the inflation rate of FLR will be a governance parameter set by the holders of FLR.

The FLR inflation rate is set to start at 10% of the originally minted 100B FLR supply per year for the first six months of Flare’s existence. After six months, the inflation rate going forward will be up for a governance vote. The FTSO rewards will serve as the mechanism for the FLR token inflation to be distributed to actors contributing to the integrity of the ecosystem’s price feeds. Thus, non-beneficial participants will not be rewarded by the inflation of FLR and in a sense over time have their FLR holdings diluted.

FTSO Inflation

Delegation Types

The FLR token features two types of delegation types when wrapped in a smart contract. Percentage delegation will be used by most users within their own wallets. This type of delegation allows a FLR address to delegate to two signal providers on a percentage basis of all wrapped spark (WFLR) in their wallet. Additionally, whenever new WFLR arrives at the address, these WFLR will be automatically delegated out based on the predetermined percentages. Explicit delegation allows for more than two delegations to signal providers from a single address. This delegation type will more commonly be used by smart contracts in dApps. Explicit delegation allows one to delegate votes based on WFLR amounts rather than percentages; however, this will be more expensive from a gas fee perspective. Once an address utilizes one of the delegation methods, then it will be locked into that method in perpetuity.

FTSO Reward Epochs

Due to the probabilistic nature of the Flare Network, the FTSO has slightly variable reward periods defined as epochs. These epochs currently last seven days, but can be changed by governance into the future. At the outset of the Flare Network, the FTSO system will randomly choose the first voting power lock date and time. All WFLR delegations to signal providers will be locked in at this time with the epoch rewards period ensuing roughly 48 hours after the lock. The epoch rewards period will last seven days with FLR inflation rewards being claimable at the end of the rewards epoch. Once the voting power lock occurs, users can start changing delegations for the next lock which will occur in seven days.