Article by Ash ☀️,

Self minting:

- Use your own collateral, avoid paying 5%? fee in XRP for e.g.

- Regarding risk of liquidation, if a self-minter’s FLR collateral drops below required threshold my guess is that there will be auto-self redemption so you’d get your XRP back + your collateral. So no actual loss of any assets. We don’t have details on this so this is just speculation but the entire self-minting process doesn’t add any risk into the system so it doesn’t make sense to be penalised

One would want to use the collateral from Lending Agents if you are happy to pay the 5% fee (subject to change, supply v demand). So let’s say you can recoup that 5% fee in terms of $$ value by holding the F-asset for a month and earning the FLR rewards, then that might make sense to someone to pay that fee

The risk with using Lending agents collateral is that in the case they do not honour their redemption (partially or completely), you’d get reimbursed in FLR. And the Lending agent gets a huge penalty, so they’re strongly incentivised to honour your redemption

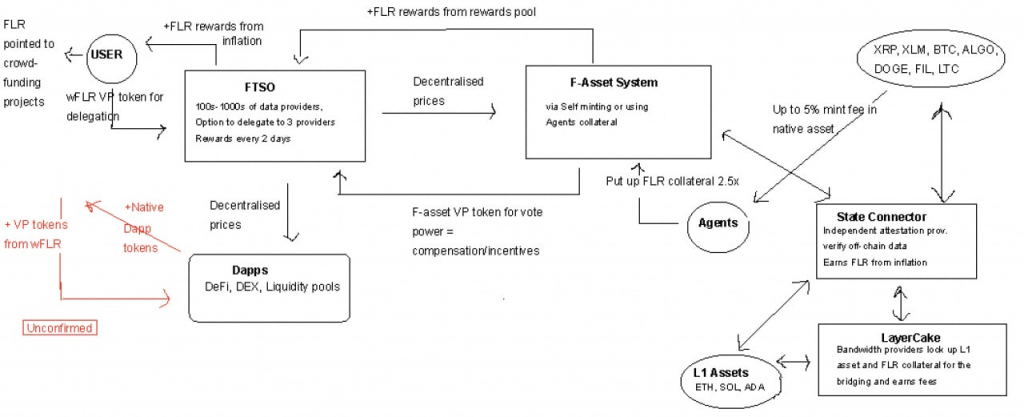

In terms of strategy with F-assets it all depends on how much value/TVL is locked up in F-assets. If F-asset pools are initially low TVL, then you minting a lot will earn you a higher amount of FLR rewards – whether you choose to self mint or use Lending agent is up to you (as above). You won’t need to top up any underlying assets unless you want to mint more F-assets. Strategies get more advanced when DeFi apps come onto flare and FLR can be used in liquidity pools with Dapp tokens where you might earn more in fees on DEX than putting up your own collateral. Or FLR used to crowdfund projects

Re taking profits in the future: we will have plenty of on-chain metrics to evaluate FLR’s value. For example, % of circulating supply that is delegating (currently 60% on SGB?), F-asset TVL and corresponding FLR collateral, is the future FLR inflation going to FTSO, collateral or DeFi TVL, Available Collateral available on Layercake Bandwidth.. All these metrics will give us a sense of where the FLR is being used and how much of it is “lazy, speculative FLR” to determine whether its overvalued or not